Compare Insurance Plans and Rates Easily

Navigating the landscape of insurance plans and rates is essential in today’s economy, where coverage options are vast yet often confusing. As more individuals seek to make informed decisions regarding their insurance, understanding the fundamental aspects of different plans becomes crucial. For instance, in examining healthcare insurance, it is important to consider the mechanisms of funding and the implications of coverage levels, as highlighted in (John B Shoven et al.). Furthermore, data shows that a significant portion of Americans, including 68.4% of insured individuals, acquire coverage through employer-sponsored plans, although this trend is gradually declining (Frazier et al.). This shift in how insurance is accessed necessitates a comprehensive analysis of available options, thereby fostering greater consumer awareness. Supporting this discussion, effectively visualizes the key differences between renters and homeowners insurance, underscoring the importance of clarity in comparative analysis as individuals strive to optimize their coverage.

A. Importance of understanding insurance plans and rates

Understanding insurance plans and rates is crucial for consumers to navigate the complexities of healthcare and financial protection effectively. With the Affordable Care Act prompting increased enrollment in health insurance marketplaces, individuals, particularly those with lower health literacy, may struggle to comprehend their options, potentially leading to inadequate coverage and financial distress (Barnes et al.). Likewise, the varying structures of Medicare and other health benefit plans necessitate a critical examination of plan features to make informed decisions . Consumers must also recognize factors such as demographics and lifestyle that influence insurance costs, as depicted in comparative analyses of renters versus homeowners insurance, which highlight significant differences in coverage needs and financial implications . By fostering a comprehensive understanding of insurance intricacies, individuals can better secure their health and financial wellbeing, ultimately enhancing their overall quality of life.

| Type | Coverage Length | Builds Cash Value | Death Benefit | Best For |

| Term | Temporary (10-30 years) | No | Fixed | Most people, income replacement |

| Whole | Lifetime | Yes | Fixed | Lifelong coverage, estate planning |

| Universal | Lifetime | Yes | Flexible | Flexibility in premiums and coverage |

| Variable | Lifetime | Yes | Flexible | Investment-savvy individuals |

| Burial | Lifetime | Yes | Fixed | Covering final expenses |

II. Types of Insurance Plans

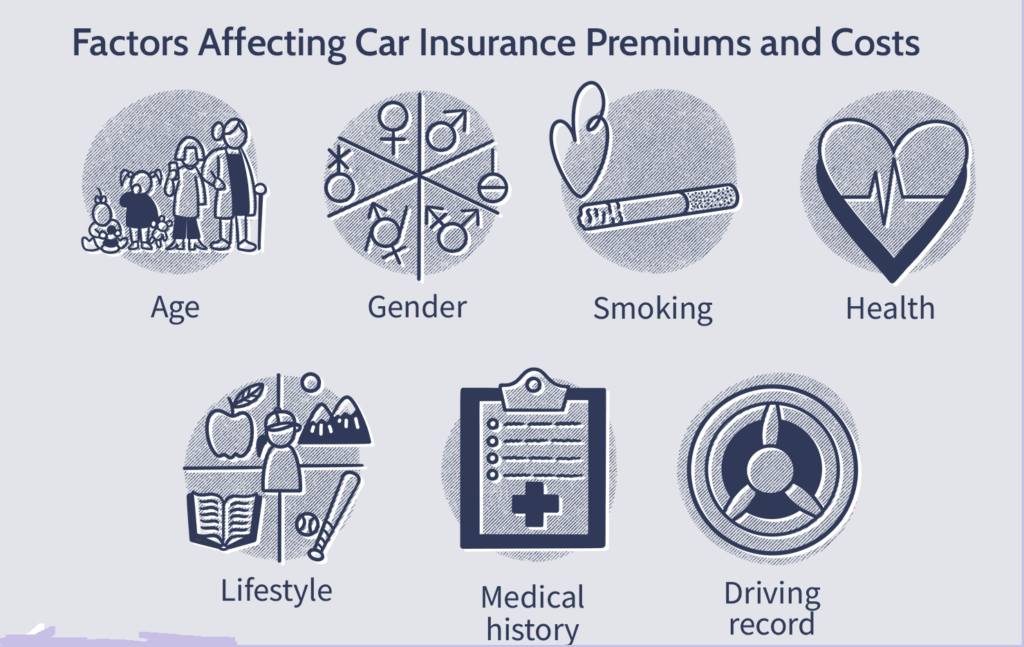

Among the various types of insurance plans available, health insurance, auto insurance, and property insurance each serve distinct functions in protecting individuals from financial risks. Health insurance plans vary significantly, with options like HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations) influencing the choice based on factors such as premiums and out-of-pocket costs. Furthermore, understanding the variables that impact healthcare costs is critical; as demonstrated in (N/A), these include not only the structure of insurance plans but also broader economic factors. Auto insurance policies, on the other hand, must consider diverse factors such as age, driving record, and geographical location, which are clearly illustrated in . Lastly, property insurance distinguishes between renters’ and homeowners’ insurance, effectively addressed in , which delineates coverage options and average costs. Grasping these distinctions enables consumers to navigate the complexities of insurance plans more effectively.

A. Overview of common insurance types (health, auto, home, etc.)

Understanding the variety of common insurance types is essential for individuals seeking to compare insurance plans and rates effectively. Health insurance serves as a primary financial safeguard against medical expenses, often varying significantly based on coverage levels and provider networks. Auto insurance, a legal requirement in many jurisdictions, protects against vehicle damage and liabilities resulting from accidents, with rates influenced by personal driving records and demographic factors (Hoadley J). Home insurance mitigates risks associated with property damage and loss, necessitating careful consideration of coverage types, such as dwelling and liability protection, as highlighted in . Additionally, specialized policies for renters and condo owners further illustrate the range of options available to consumers. Each insurance type embodies distinct features and pricing structures, emphasizing the importance of comprehensive market research as suggested in (Department CA) and (Barseghyan et al.) to facilitate informed decision-making in personal finance.

III. Factors Influencing Insurance Rates

Numerous factors influence insurance rates, shaping the financial landscape for consumers and businesses alike. Key determinants include individual risk profiles, claims history, and the potential for liabilities, all of which insurance companies meticulously evaluate to set premiums. Elements such as location, coverage limits, and the type of policy further contribute to the complexity of these rates. For instance, the impact of geographic location often correlates with local crime rates and environmental risks, significantly affecting homeowner insurance costs. Additionally, the design of employer-sponsored plans can lead to variations in employee benefits, which, as highlighted by (Mitchell et al.), showcases the relationship between public policy dynamics and insurance offerings. Furthermore, (Barringer et al.) explores the organizational theories relating to employee benefits, emphasizing how these theories affect the adoption and adaptation of insurance products. Ultimately, understanding these factors is crucial for consumers seeking to compare and select suitable insurance plans effectively.

A. Key elements that affect insurance pricing (age, location, coverage level, etc.)

Several key elements significantly influence insurance pricing, including age, location, and the level of coverage selected. Age acts as a crucial factor as insurers often categorize younger individuals as higher risks due to their inexperience, resulting in elevated premium rates. Similarly, location plays a pivotal role; individuals living in areas with high crime rates or natural disaster risks face increased costs to offset potential claims. The level of coverage also directly affects pricing, with more comprehensive plans naturally commanding higher premiums. Moreover, systemic industry changes can further impact these elements, such as those examined in the context of health insurance markets where structural adjustments may lead to different pricing outcomes (Elliot K Wicks). Additionally, variations in employer-provided health benefits linked to factors like unionization further illustrate the interconnectedness of these elements in determining insurance costs (DiNardo J et al.). Consequently, understanding the complexities of these factors can empower consumers to make informed decisions while comparing plans. effectively highlights these pricing determinants, reinforcing their importance in consumer assessments.

The image illustrates the various factors that influence car insurance premiums and costs. It is structured with icons representing each factor: Age, Gender, Smoking, Health, Lifestyle, Medical History, and Driving Record. This visual representation emphasizes the multifaceted nature of insurance assessments and the demographic as well as lifestyle variables that insurers consider when determining rates. It serves as a concise summary of critical determinants in the field of insurance, particularly in relation to risk assessment and pricing models.

Image1 : Factors Influencing Car Insurance Premiums

comparing insurance plans and rates is essential for consumers seeking optimal financial protection tailored to their individual needs. As highlighted, understanding the myriad factors influencing insurance premiums can significantly empower consumers in their decision-making processes. For instance, variables such as socioeconomic status and health can impact consumer cost-sharing and overall spending on insurance, as discussed in (Swartz K). Additionally, the comparative analysis of different types of insurance, such as the distinctions between renters and homeowners insurance, can further aid in identifying appropriate coverage, as depicted in . The ongoing necessity for consumers to monitor not just the costs, but also the varied insurance options available, ensures that they can navigate the complexities of the insurance landscape effectively. Ultimately, through informed comparisons, individuals can secure the most advantageous policies aligned with their risk profiles and financial situations.

A. Summary of the benefits of comparing insurance plans and rates effectively

The thorough comparison of insurance plans and rates provides significant benefits that empower consumers to make informed decisions anchored in financial prudence. By evaluating different policies, individuals can uncover various coverage options, ensuring alignment with personal needs and preferences. Such diligence can lead to cost savings, as better understanding of the market often reveals more competitive pricing structures. For instance, the visual summary in distinctly delineates the disparities between renters and homeowners insurance, highlighting critical factors that should influence one’s choice. Additionally, findings from (Elliot K Wicks) and (Pollitz K et al.) emphasize the importance of understanding the marketplace dynamics, which can optimize coverage while enhancing affordability. By systematically assessing available options, consumers can not only secure adequate protection, but also contribute to a more stable insurance market, ultimately benefiting from a tailored insurance strategy that minimizes financial risk and maximizes personal coverage goals.