Find Affordable Insurance Solutions Today

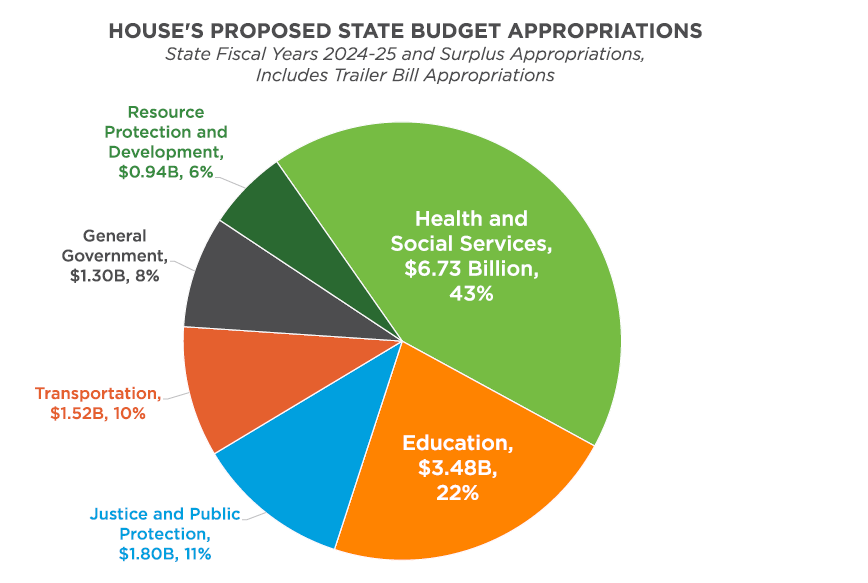

Access to affordable insurance solutions is a critical factor in promoting equitable healthcare for all individuals. In the United States, disparities in health outcomes linked to race, ethnicity, and socio-economic status are exacerbated when individuals lack sufficient insurance coverage (Carlson C et al.). The introduction of the Affordable Care Act (ACA) has provided pathways for many to secure insurance, particularly in states like Colorado, which embraced Medicaid expansion and state-based exchanges, fostering a more inclusive healthcare landscape (Bontrager J et al.). However, significant barriers remain, underscoring the necessity for comprehensive strategies aimed at improving access to insurance. This includes addressing systemic issues such as geographic disparities and economic instability, which impede individuals from obtaining necessary health care. Furthermore, the visual representation of budget appropriations illustrates the prioritization of health services in state planning, reinforcing the importance of financial strategies in the quest to achieve affordable insurance solutions today.

A. Overview of the importance of affordable insurance in today’s economy

In todays economy, the significance of affordable insurance cannot be overstated, as it serves as a critical financial safety net for individuals and families alike. The growing uncertainty in the job market, coupled with rising healthcare costs, underscores the necessity for accessible insurance options. Without affordable coverage, many may face debilitating financial burdens during unexpected events such as illness or accidents, further exacerbating economic disparities. As noted in various studies, access to affordable insurance enhances both individual well-being and overall public health outcomes, thereby contributing to a more stable economy ((University of Montana–Missoula. Bureau of Business and Research E)). This affordability allows for enhanced consumer confidence, enabling individuals to make economic decisions without the constant fear of catastrophic financial loss ((University of Montana–Missoula. Bureau of Business and Research E)). Ultimately, prioritizing affordable insurance solutions is essential in fostering a resilient economy that accommodates the needs of all its members.

II. Understanding Different Types of Insurance

A comprehensive understanding of the various types of insurance is essential for consumers seeking affordable solutions tailored to their specific needs. Health insurance, for instance, goes beyond mere medical coverage, addressing prevailing social determinants of health as highlighted in (C J Hager E). This type of insurance can significantly impact an individual’s economic security, especially when factoring in costs associated with childcare, transportation, and healthcare. Similarly, property and casualty insurance protects against risks to personal and commercial assets, offering peace of mind in unpredictable circumstances. Furthermore, analyzing budget allocations, such as those shown in , underscores the critical role health and social services play within state budgets, emphasizing the necessity for adequate and accessible insurance options. Understanding these insurance types helps individuals navigate their choices while ensuring financial stability, fostering informed decisions for a secure future.

| InsuranceType | Coverage | AverageCost | TypicalPolicyLength |

| Auto Insurance | Vehicle damage, liability | $1,674/year | 6-12 months |

| Homeowners Insurance | Property damage, liability | $1,312/year | 12 months |

| Life Insurance | Death benefit | $26/month | 10-30 years or lifetime |

| Health Insurance | Medical expenses | $7,739/year | 12 months |

| Disability Insurance | Income replacement | 1-3% of annual income | 2-5 years or until retirement |

A. Explanation of various insurance types (health, auto, home, etc.) and their relevance

Various types of insurance, including health, auto, and home coverage, play a vital role in fostering financial security and mitigating risks associated with unpredictability in daily life. Health insurance, for instance, significantly influences accessibility to essential medical services, as seen in the context of North Carolinas Medicaid program, which highlights disparities in health coverage across different demographics and economic strata (Rice et al.). Auto insurance protects individuals from the financial repercussions of vehicle accidents, while homeowners insurance safeguards against loss due to theft or natural disasters. Collectively, these insurance types not only enhance individual stability and peace of mind but also contribute to broader economic health by supporting community resilience and public safety initiatives. The importance of municipal budgeting, illustrated in budget distributions for health services , underscores how insurance frameworks can influence local economies and, by extension, societal welfare.

III. Strategies for Finding Affordable Insurance

In the quest for affordable insurance, it is imperative to explore a range of strategies that adapt to individual needs and circumstances. One effective approach is the consideration of Cooperative Health Insurance Plans (CO-OPs), which emphasize innovative, nonprofit models designed specifically for individuals and small businesses. These structures not only offer competitive pricing but also foster community engagement in healthcare decisions, aligning with the provisions outlined in federal health reform laws (Mendelevitz M et al.). Additionally, understanding the various subgroups among the uninsured population can lead to tailored solutions, such as eligibility for public programs and mandates that address specific demographic needs (Murphy B et al.). Visual aids, such as the tree diagram depicting a mental health care ecosystem , exemplify the interconnectedness of available resources, underscoring the importance of a comprehensive approach to finding affordable insurance that enhances accessibility, ensures financial stability, and promotes overall community health.

A. Tips and resources for comparing insurance quotes and policies

When seeking affordable insurance solutions, carefully comparing quotes and policies is crucial to ensure maximum value. Start by gathering multiple quotes from different providers, utilizing online comparison tools that streamline this process and provide a side-by-side analysis of coverage options and costs. Additionally, consider reading customer reviews and ratings to assess overall satisfaction with the providers. It is also important to examine the fine print of each policy, as exclusions and limitations can significantly impact your coverage. Resources from organizations such as NeighborWorks America emphasize the need for educating consumers about navigating insurance products, which can empower individuals to make informed decisions that cater to their specific needs (N/A). Furthermore, understanding the advantages and disadvantages of different insurance types can lead to better alignment with one’s financial goals, a vital aspect highlighted in discussions around manufactured housing and its financing practices (Calder A et al.). For clarity, a visual representation of budget allocations, such as , can further emphasize the financial planning necessary when evaluating insurance policies.

Finding affordable insurance solutions requires a multifaceted approach that addresses not only the financial implications but also the accessibility and quality of care. As policymakers navigate these complexities, they must consider models that effectively reduce costs while enhancing the coverage options available to consumers, thereby preventing adverse selection within the marketplace (Haase LW et al.). Additionally, proposing strategies that utilize federal resources efficiently can ensure continuity of coverage and promote financial feasibility (Bachrach D et al.). The considerations depicted in , which illustrates the California state budget prioritizations, emphasize the significance of strategic investments in health services. Such visual representations serve to stress that robust funding in health and social services is essential for creating equitable insurance solutions. By prioritizing these elements, stakeholders can develop more comprehensive health insurance frameworks that adapt to the evolving needs of the population, ultimately leading to better health outcomes for all.

A. Summary of key points and the importance of taking action to secure affordable insurance solutions

In addressing the pressing need for affordable insurance solutions, it becomes essential to summarize pivotal points that underline the urgency of action. The historical context reveals the ongoing struggle against socioeconomic disparities, reminiscent of initiatives like the War on Poverty initiated by President Lyndon B. Johnson, emphasizing the importance of adopting fresh strategies for modern challenges (Rynell A et al.). Furthermore, understanding public perception is crucial, as evidenced by analyses showing that a significant discrepancy exists between public opinion on affordable housing and the realities faced by many (N/A). This gap highlights the broader narrative regarding accessibility to essential resources, including insurance. Consequently, taking decisive measures not only fosters greater community support but also ensures that solutions align with current societal needs. Such comprehensive actions are fundamental to constructing a robust framework that enables all individuals to gain equitable access to affordable insurance solutions, which ultimately benefits the wider community .