Secure Your Rental with Top-Rated Renters Insurance

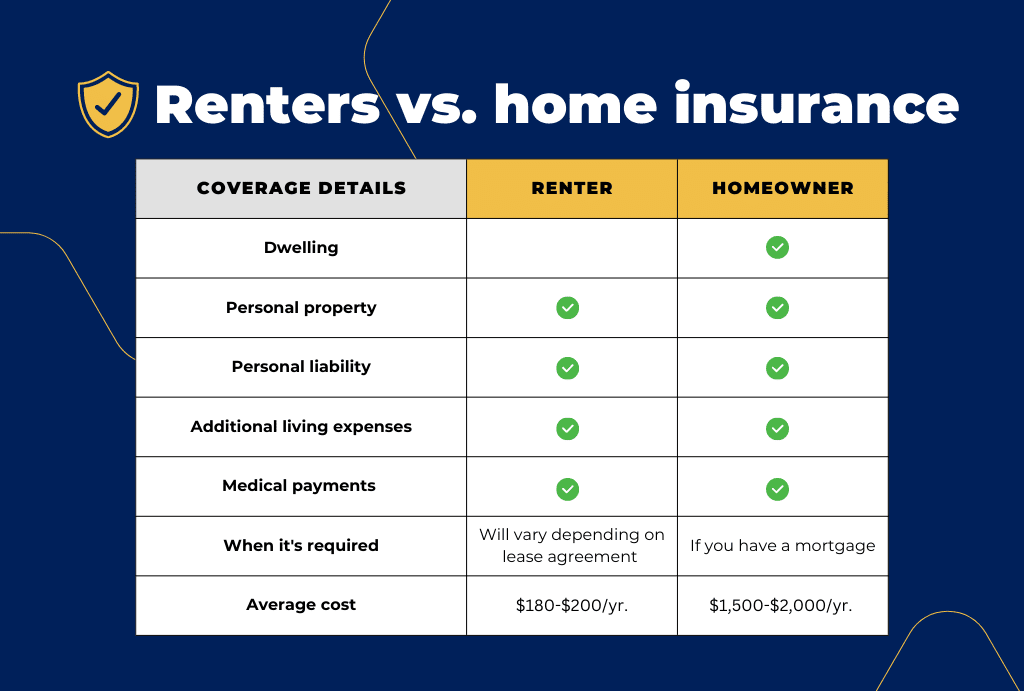

The necessity of implementing renters insurance is underscored by the growing economic pressures faced by many individuals renting their homes. As the landscape of housing affordability shifts, particularly for retirees and disadvantaged demographics, the need for comprehensive coverage becomes increasingly apparent. Renting, especially in urban environments, exposes individuals to a myriad of risks, from theft to natural disasters, yet many tenants remain unaware of their vulnerability without adequate insurance ((Knox D et al.)). Furthermore, as highlighted by data from the Center for Applied Urban Research, a significant portion of the low-income population lacks sufficient protection against these risks ((Frost et al.)). Understanding the difference between renters and homeowners insurance is crucial, as seen in , which clearly delineates the coverage discrepancies that can leave renters significantly more exposed in times of crisis. Therefore, securing top-rated renters insurance is not merely a precaution but a critical safeguard for personal assets and peace of mind.

A. Importance of Renters Insurance in Protecting Personal Property

In an era where unforeseen events can lead to substantial financial loss, renters insurance emerges as a critical safeguard for personal property. This type of insurance not only protects possessions from common risks such as theft, fire, or water damage but also provides liability coverage in the event of an accident involving visitors. As highlighted by research, the importance of having such coverage is underscored by the growing number of low-income families navigating an increasingly precarious rental market (N/A). Without renters insurance, individuals risk losing their valuable belongings without any means of recovery, fundamentally jeopardizing their financial stability. Moreover, as depicted in the comparative analysis provided in , renters insurance offers essential coverage options at a fraction of the cost of homeowners insurance, making it an accessible choice for many. Thus, investing in renters insurance is not merely prudent; it is a vital component of secure, responsible living.

II. Understanding Renters Insurance

Understanding renters insurance is essential for safeguarding ones personal property and minimizing financial liability. This type of insurance provides coverage for tenants’ belongings, which can include furniture, electronics, and personal items in the event of theft or damage, an aspect often overlooked by renters who mistakenly assume that their landlord’s policy covers their possessions. Moreover, the implications of housing insecurity emphasized by social determinants of health (SDoH) further illustrate the necessity of such insurance, particularly for low-income families facing unstable living conditions (Dove et al.). By mitigating the financial burden associated with unexpected incidents, renters insurance fosters stability and peace of mind. A detailed comparison between homeowners and renters insurance reveals distinct differences, with the former covering the property itself and the latter focusing solely on tenants possessions and liability . Hence, investing in renters insurance is a prudent step towards securing one’s rental situation effectively.

A. Key Components of a Renters Insurance Policy

A comprehensive understanding of the key components of a renters insurance policy is essential for tenants seeking financial protection. Typically, a renters insurance policy includes coverage for personal property, which safeguards the tenants belongings against theft or damage from various hazards, such as fire or water. Additionally, personal liability coverage is crucial, as it protects tenants against claims arising from injuries or accidents that may occur on their rented property. Furthermore, additional living expenses coverage comes into play if tenants are displaced due to a covered event, allowing them to maintain their standard of living while repairs are made. The complexities of these components are effectively illustrated in , which contrasts renters and homeowners insurance policies, highlighting the distinct aspects of coverage. Understanding these elements enables renters to secure the most suitable insurance that adequately meets their needs and mitigates risks associated with renting a home (INU et al.), (Knox D et al.).

| Component | Description | Typical Coverage Range | Average Cost Impact |

| Personal Property Coverage | Protects belongings like furniture, clothing, and electronics | $10,000 – $100,000 | Moderate |

| Liability Coverage | Covers legal expenses if someone is injured in your rental | $100,000 – $500,000 | Low |

| Additional Living Expenses | Pays for temporary housing if your rental becomes uninhabitable | $3,000 – $10,000 | Low |

| Medical Payments Coverage | Covers medical costs for guests injured in your rental | $1,000 – $5,000 | Very Low |

III. Benefits of Top-Rated Renters Insurance

Furthermore, top-rated renters insurance serves as an essential tool for protecting ones belongings against unforeseen events, thereby providing peace of mind to tenants. This type of insurance typically covers personal property against damage or loss from various incidents, including theft, fire, or water damage, which can be particularly beneficial in uncertain rental markets. As highlighted in recent studies, the demand for rental housing has surged, yet the financial strain on renters has also increased, leading to heightened concerns about housing stability and affordability ((N/A)). Without adequate protection, renters risk bearing substantial financial burdens following unexpected damages. By securing comprehensive renters insurance, tenants can mitigate these risks and focus on enjoying their living spaces. Additionally, top-rated insurers often provide resources that assist in navigating the complexities of rental agreements and tenant rights, further enhancing the overall rental experience ((Bentzinger et al.)).

A. How Top-Rated Policies Provide Enhanced Coverage and Peace of Mind

When evaluating how top-rated renters insurance policies enhance coverage and provide peace of mind, it is essential to recognize the strengths that such policies offer over standard options. Comprehensive coverage options typically include personal property, liability protection, and additional living expenses, which collectively serve to mitigate the financial strain during unforeseen events. Furthermore, research indicates that policies providing extensive support following adverse incidents, such as floods, play a crucial role in fostering resilience among affected individuals (cite11). For example, top-rated policies often adapt to the evolving housing landscape, aligning with the necessary protections amid demographic shifts and changing rental needs (cite12). The careful consideration of these elements not only enables renters to secure their belongings but also cultivates a sense of security, allowing them to navigate challenges with confidence. This synthesis of robust coverage and institutional backing establishes a reliable safety net, ultimately enhancing the rental experience. For a visual representation of these distinctions and the comparative benefits between renters and homeowners insurance, see .

securing renters insurance emerges as an indispensable measure for individuals who wish to protect their livelihoods and assets from unforeseen events. The statistics illustrated in effectively highlight the differences in coverage between renters and homeowners insurance, emphasizing the critical need for renters to safeguard their personal property. As the landscape of housing becomes increasingly fraught with challenges, including rising costs and diminishing affordability, it is evident that effective risk management through renters insurance can greatly alleviate these burdens. Scholar analyses, such as those presented in (Australia A) and (Knox D et al.), call attention to the growing demographic of renters, particularly among aging populations and low-income households, who find themselves vulnerable in an unstable market. By investing in top-rated renters insurance, tenants not only secure their current living conditions but also contribute to their long-term financial stability in an uncertain economic climate.

A. The Necessity of Choosing the Right Renters Insurance for Security and Protection

Selecting the appropriate renters insurance is crucial for securing personal belongings and safeguarding against potential liabilities. Often overlooked, this type of insurance provides essential protection in the event of theft, damage, or unexpected incidents within a rental property. Notably, distinct coverage differences exist between renters and homeowners insurance, as highlighted in , which offers a comparative analysis of coverage aspects. An effectively chosen renters insurance policy can cover personal property, medical payments, and additional living expenses, thus acting as a risk management strategy when dealing with unforeseen circumstances. Furthermore, the necessity of a strong rental sector has gained attention, suggesting that support for effective rental housing options is vital in urban planning and community stability, as proposed in (Godbout M et al.). By understanding these facets, renters can make informed decisions that enhance their security and peace of mind, ultimately leading to a more stable living environment.

FOR MORE : AI in Insurance: How Artificial Intelligence Reduces Fraud, Travel Insurance: What’s Covered and What’s Not,

This Post Has One Comment