Top insurance plans to choose for term insurance

Term Insurance and Its Importance – Term insurance serves as a crucial financial tool designed to provide financial security to beneficiaries in the event of the policyholders untimely death. By paying a relatively low premium, individuals can ensure substantial coverage, making it an attractive option for families looking to safeguard their future. Unlike whole life policies, term insurance is designed for a specific time frame, typically ranging from ten to thirty years, during which benefits can be claimed if the insured passes away. This makes it particularly important for those with dependents who rely on their income. Furthermore, term insurance often allows for conversion to permanent policies, which adds a layer of flexibility to the product. As illustrated in , the concept of term insurance emphasizes protection and financial planning, making it an essential consideration when evaluating top insurance plans.

II. Key Features to Consider When Choosing a Term Insurance Plan

When selecting a term insurance plan, several key features demand careful consideration to ensure alignment with individual financial goals and needs. The policyholder must evaluate coverage amounts relative to their family’s financial obligations, such as outstanding debts and ongoing living expenses. Additionally, the duration of the coverage is critical; policies may range from short to long-term, impacting premiums and benefits over time. Its also essential to assess the insurers claim settlement ratio, as this statistic reflects the companys reliability in honoring claims. Moreover, riders can enhance a term policy, offering additional benefits like critical illness coverage or accidental death benefits at an extra cost. Understanding these components allows individuals to make informed decisions, safeguarding their loved ones financial future. The visual representation in , which outlines fundamental principles of life insurance, underscores the significance of these features when choosing an appropriate plan.

III. Overview of the Top Insurance Plans Available in the Market

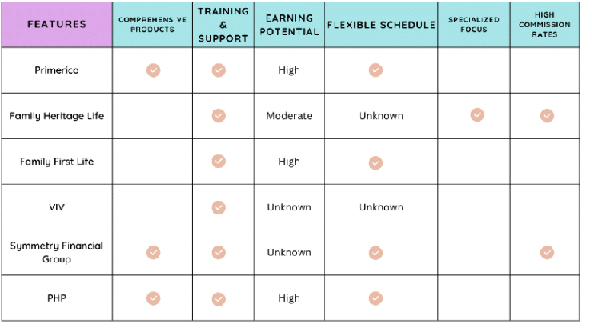

In evaluating the top insurance plans available in the market, it is essential to consider not only the policy details but also the variety of products offered by different companies. Notable providers such as Primerica and Family First Life exemplify the range of options available, catering to diverse customer needs with specific plans that emphasize affordability and comprehensive coverage. These companies often offer extensive training and support for their agents, allowing them to successfully address consumer concerns and promote beneficial insurance solutions, which is pivotal for enhancing market accessibility ((Chan et al.)). Furthermore, regulatory strategies play a crucial role in shaping the landscape of individual health insurance, as states implement reforms to foster a more competitive market, ultimately aiding consumers in accessing policies that meet their financial constraints and health needs ((Amy M Tiedemann et al.)). An illustrative comparison of these companies can be found in , which highlights their various strengths, facilitating informed decisions for consumers.

Image1 : Comparison of Financial Services Companies Based on Key Features

IV. Factors Influencing the Selection of the Best Term Insurance Plan

When selecting the best term insurance plan, consumers must navigate an array of influencing factors, including premium costs, coverage amounts, and policy terms. Notably, the premium reflects both the risk profile and the financial stability of the insurance provider, which is crucial because these elements significantly affect long-term affordability and sustainability of coverage. Furthermore, the dynamic nature of health and age can lead to adverse selection, where consumers with higher health risks gravitate towards more comprehensive plans, as outlined in the findings of (Cutler et al.). Such behavior highlights the necessity of evaluating not just current needs but potential future health conditions. Additionally, as user satisfaction is critical, insurance providers must deliver value that aligns with consumer expectations, suggesting a transaction process vital to maintaining engagement and loyalty, as described in (Gerhart et al.). To visually grasp these complexities, encapsulates the essence of life insurance contracts and protections, enhancing our understanding of the term insurance landscape.

V. Conclusion

In conclusion, selecting the right term insurance plan is a critical decision that requires careful consideration of various factors, including coverage options, premium costs, and the reputation of the insurance provider. The landscape of term insurance is diverse, with numerous plans available to cater to the unique needs of individuals and families. By evaluating the top insurance plans and understanding their respective benefits and limitations, consumers can make informed choices that offer financial security for their loved ones. The importance of aligning personal financial goals with the selected policy cannot be overstated, as it ensures that policyholders secure the most suitable protection for the future. Highlighted by the visual representation in , which encapsulates the essence of life insurance and its protective nature, the right choice in term insurance can bring peace of mind and a sense of security to policyholders and their beneficiaries alike.

References:

- Chan, Louis. “Industry Comparison of Executive Compensation and Equity Considerations”. University of New Hampshire Scholars\u27 Repository, 2012, https://core.ac.uk/download/72047979.pdf

- Amy M. Tiedemann, Margaret M. Koller, Nancy C. Turnbull, Nancy M. Kane. “Insuring the Healthy or Insuring the Sick? The Dilemma of Regulating the Individual Health Insurance Market — Short Case Studies of Six States”. ‘The Commonwealth Fund (CMWF)’, 2005, https://core.ac.uk/download/71352302.pdf

- Anne K. Gauthier, Cathy Schoen, Karen Davis, Sara R. Collins, Stephen C. Schoenbaum. “A Roadmap to Health Insurance for All: Principles for Reform”. ‘The Commonwealth Fund (CMWF)’, 2007, https://core.ac.uk/download/71354536.pdf

- Alina Salganicoff, Karen Pollitz, Mila Kofman, Usha Ranji. “Maternity Care and Consumer-Driven Health Plans”. Henry J. Kaiser Family Foundation, 2007, https://core.ac.uk/download/71348163.pdf

- Cutler, David, Lincoln, Bryan, Zeckhauser, Richard. “Selection Stories: Understanding Movement across Health Plans”. 2025, https://core.ac.uk/download/pdf/6508660.pdf

- Gerhart, Barry A., T. , George , Milkovich. “Employee Compensation: Research and Practice”. DigitalCommons@ILR, 1991, https://core.ac.uk/download/5129129.pdf